The Term Structure of Interest Rates Relates

The term structure of interest rates reflects expectations of market participants about future changes in interest rates and their assessment of monetary policy conditions. View the full answer.

Term Structure Of Interest Rate Definition Theories Top 5 Types

The five theories are the unbiased expectations theory the local expectations theory the liquidity preference theory the segmented markets theory and.

. Terest is known as the Lerm structure of interest rates. The term structure of interest rates is also known as the yield curve. The yield or interest rate or coupon rate is taken in Y-axis and the.

When you invest your money into interest-bearing security the amount of interest paid will vary depending on the length of the investment term. In economics the relationship between different terms or maturities for instance 1 month 1 year or 10 years and the interest rates for risk-free debt is called the Term Structure of. Start your trial now.

Typically the term structure refers to Treasury securities but it can also refer to riskier securities such as AA bonds. Understanding the Term Structure of Interest Rates and the Yield Curve. As a result term structure theory is often described as the theory of the yield curve.

During 2008 the difference in yield the yield spread between three-month AA-rated financial commercial paper and three-month AA-rated nonfinancial commercial paper steadily increased from its usual level of close to zero spiking to over a full percentage point at its peak in October 2008. A term structure of interest rate shows the various yields currently offered on bonds of. The term structure of interest rates relates a.

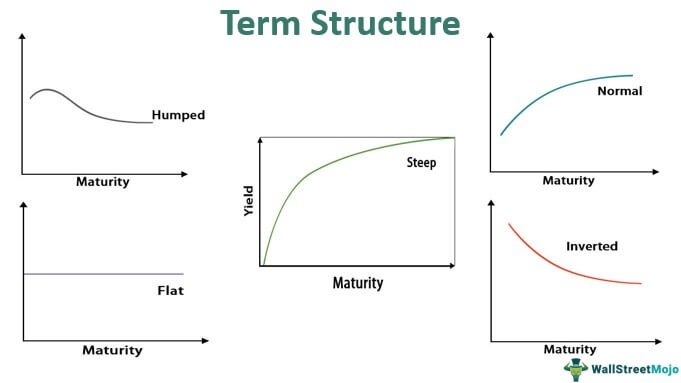

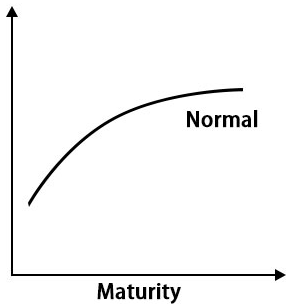

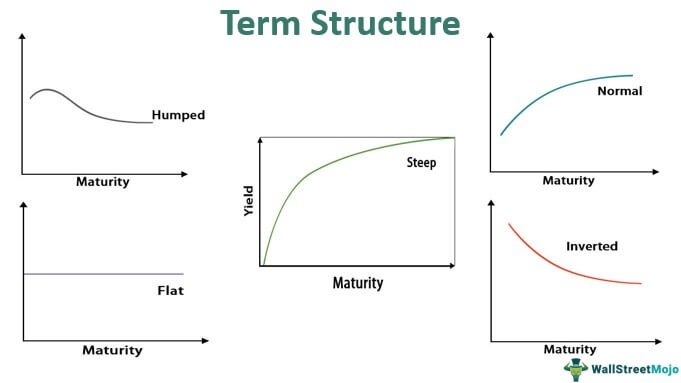

The relationship among interest rates over different time-horizons as viewed from today t 0. The term structure of interest rates is a static function that relates the A. The term structure of interest rates or the yield curve is basically a graphical representation showing the relationship between the bond yields or the yield to maturity YTM of bonds and a range of maturities.

First week only 499. Term to call and the yield to call. We discuss 5 different theories of the term structure of interest rates.

Market segmentation theory is a theory that long and short-term interest rates are not related to each other. Your employer contributes 60 a week to your. That is the forward rates equal the expected future spot rates or in other words forward rates are unbiased estimates of future spot rates.

How Does the Term Structure of Interest Rates Work. Financial Instruments Toolbox includes a set of functions to encapsulate interest-rate term information into a single structure. Term structure of interest rates commonly known as the yield curve depicts the interest rates of similar quality bonds at different maturities.

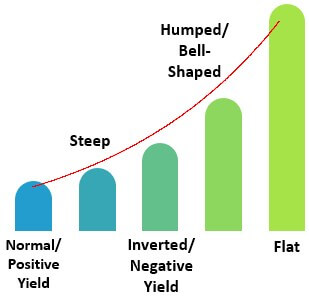

It is the interest rate difference on fixed income securities due to differences in time of maturity. Each of the different theories of the term structure has certain implications for the shape of the yield curve as well as the interpretation of forward rates. A graph of the term structure of interest rates is known as a yield curve.

The term structure of interest rates relates. What explains this sudden increase. The new object IRFunctionCurve allows the user to model an interest rate curve as a function.

The term structure can refer to at least three different curves. Term to maturity and the coupon rate. It is also referred to as the yield curve.

The term structure of interest rates is a graph that plots the yields of similar-quality bonds against their maturities from shortest to longest. Finance and related others by exploring similar questions and additional content below. This example will explore using IRFunctionCurve to model the default-free term structure of interest rates in the United Kingdom.

100 1 rating Basically the term structure of interst rate refers to the relationship between i. The Yield Curve Plots the effective annual yield against the number of. The increase in the yield spread was a result of the.

In other words a savings bond with a one year term may pay a fairly low interest rate but if you invest your money in a bond with a ten. What Is the Term Structure of Interest Rates. The Term Structure of Interest Rates What is it.

Term to call and the yield to maturity. Term to maturity and the current yield. A concept closely related to this.

The term structure of interest rates refers to the relationship between market rates of interest on short- term and long-term securities. To display the term structure of interest rates on securities of a particular type at a par-ticular point in time economists use a diagram called a yield curve. Bonds that are plotted on the graph are of the same quality or we can say having the same risk profile.

Yields and credit ratings. Today that account is worth 31406. Who are the experts.

It also states that the prevailing interest rates for short intermediate and long-term bonds should be viewed separately like items in different markets for debt securities. These functions present a convenient way to package all information related to interest-rate terms into a common format and to resolve interdependencies when one or more of the parameters is modified. We review their content and use your feedback to keep the quality high.

The term structure of interest rates refers to the relationship between the yields and maturities of a set of bonds with the same credit rating. Stock and bond yields. What rate of interest is Towne Station earning on this investment.

The unbiased expectations theory of the term structure adds a behavioral interpretation to the mathematical relationships embodied in the term structure of interest rates. Solution for Explain the difference between the unbiased expectations theory of the term structure of interest rates and the liquidity premium theory. This curve is plotted between the interest rates offered by similar kinds of bonds with different maturities.

Experts are tested by Chegg as specialists in their subject area. Economists are interested in term structure. The discount curve zero curve or forward curve.

Term to maturity and the yield to maturity.

Term Structure Of Interest Rates Theories Bbalectures Interest Rates Business Articles Finance

Term Structure Of Interest Rate Definition Theories Top 5 Types

Term Structure Of Interest Rate Definition Theories Top 5 Types

/YieldCurve2-362f5c4053d34d7397fa925c602f1d15.png)

No comments for "The Term Structure of Interest Rates Relates"

Post a Comment